Systems of Execution at the Intersection of Contracts and Procurement: The AI Effect

By Chris Skoff, Managing Director; Ashwini Gautam, Director; and Braeden DeWan, Director, Marks Baughan

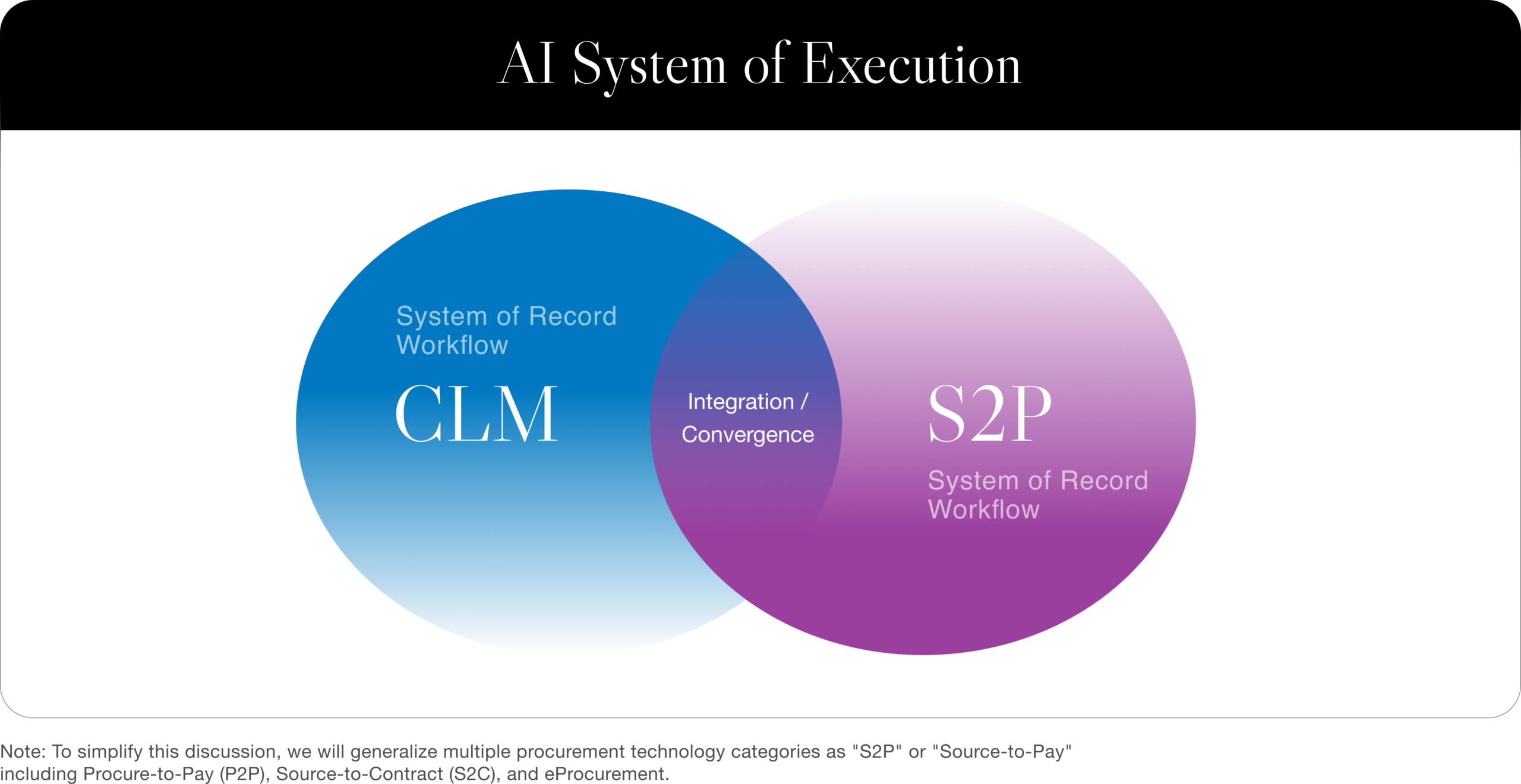

Contract lifecycle management (CLM) and Source-to-Pay (S2P) have long operated in somewhat separate corners of the enterprise — CLM in legal departments and S2P in procurement and finance departments. Yet at their cores, they manage the same thing: the company’s relationships with suppliers and how money flows to them. These spheres have already begun converging because of their overlapping workflows, shared data dependencies, and the regulatory demand for end-to-end third-party governance. But now, with the explosion of artificial intelligence, this convergence stands to accelerate at a blistering pace — creating an opportunity to establish a true “system of execution” across both domains.

AI will transform what was an integration story between two systems of record into a platform and category-evolution opportunity — catalyzing a true convergence of CLM and S2P into a unified system of execution for managing supplier risk, spend, and compliance. This shift is reshaping the way CLM and S2P software developers build, how buyers evaluate platforms, and how investors look at strategic value in this evolving space.

Convergence Was Already Underway

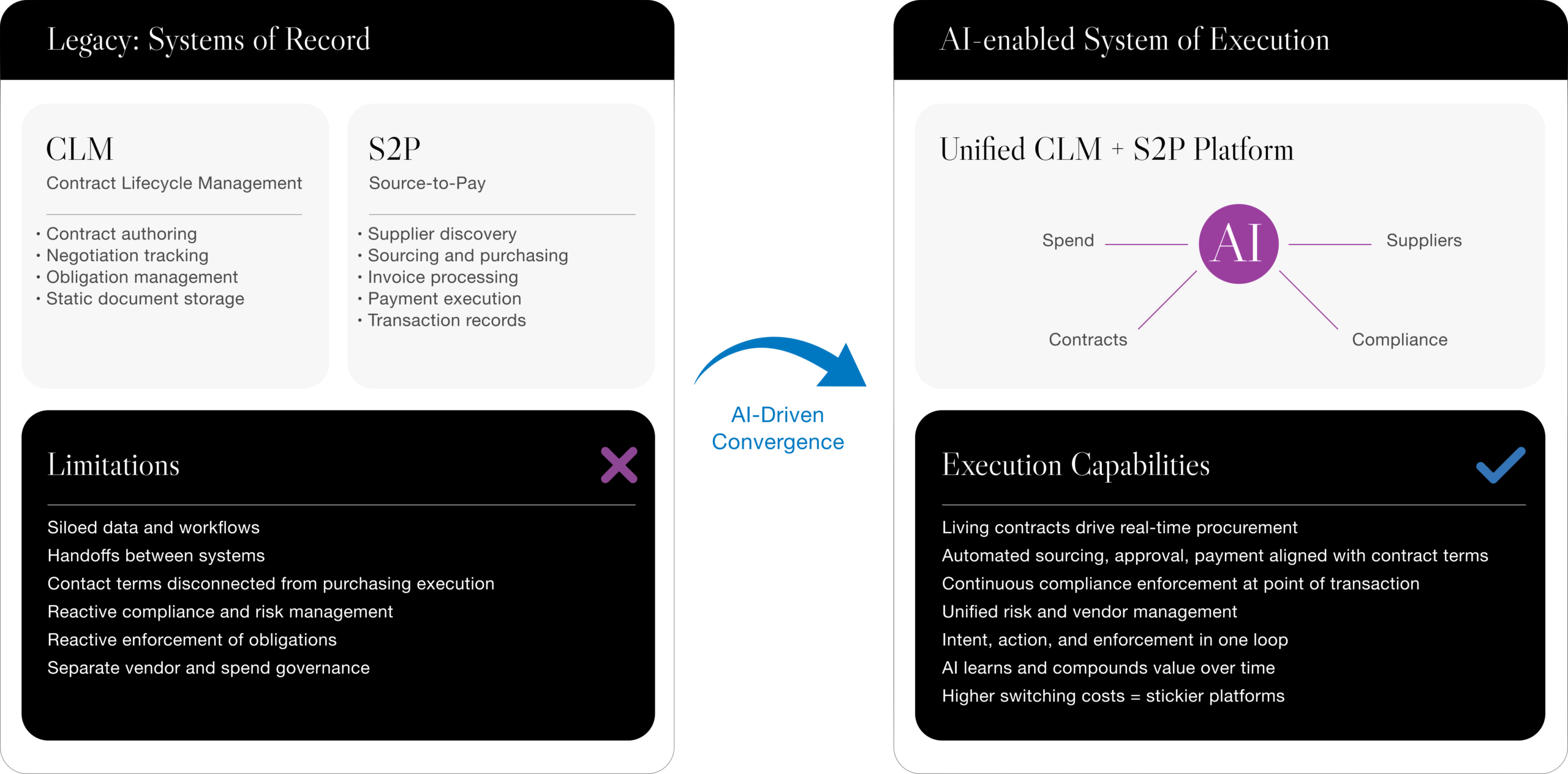

Before AI entered the scene, CLM and S2P intertwined across multiple aspects of their respective realms. Contract terms negotiated in legal workflows carried through into purchasing and payment. Spend visibility and supplier performance depended on shared data rather than siloed systems. We saw the early stages of convergence occur when S2P suites started embedding basic contracting capabilities (e.g. drafting, negotiation, and obligation tracking), and CLM platforms began to integrate natively with enterprise resource planning (ERP), procurement, and finance systems.

Strategic partnerships and some early acquisitions followed suit, increasingly focused on unifying source-to-contract and procure-to-pay concepts into broader S2P platforms. Regulatory pressure, data privacy risk, and rising third-party risk reinforced the need for tighter integration between CLM-S2P systems. Now the market is primed for AI to unify contract, supplier, and spend data and execution at scale.

Why AI Changes the Economics, Not Just the Product

AI’s value in CLM and S2P goes far beyond faster contract drafting and review or smarter spend analysis. Those gains matter, but the real impact is architectural and economic.

With AI, companies turn contracts from static documents into living, operational execution drivers. AI reads contract language, obligations, pricing, and risk clauses and applies them to purchasing in real time. Procurement teams make more-efficient, automated sourcing, approval, and payment decisions that automatically reflect policy, compliance, and risk — reducing the need for manual oversight.

But AI only delivers this value when the right data is connected. For AI to work as intended, contract details, supplier information, and spending records must live together in a shared system of execution that also incorporates regulatory rules and internal policies and controls. A fragmented system limits AI’s power here, further magnifying the need for unification.

In such a connected environment, CLM and S2P shift from functioning as systems of record to serving as systems of execution where intent, action, and enforcement happen in a streamlined loop. This shift signals a change in the economic value — rewarding architectures that support such unification.

Market Signals: Platform Strategy and Capital Alignment

The convergence of CLM and S2P is no longer theoretical — it’s shaping how innovators build software platforms and how investors value them.

Take the SAP-Icertis partnership, for example. SAP controls much of the S2P lifecycle with its product SAP Ariba, which governs supplier discovery, sourcing, purchasing, invoicing, and payment. Historically, however, Ariba lacked contract-native intelligence. That gap limited how effectively negotiated terms could guide day-to-day procurement and payment behavior.

Icertis fills that gap. As a leading CLM platform, it manages contract authoring, negotiation, obligations, pricing terms, and risk clauses. SAP and Icertis began collaborating several years ago, but in 2022, they expanded that relationship into a deeper strategic partnership, including tighter product integration and a joint roadmap.

That partnership underlines the strategic need for contract intelligence to inform execution within procurement. Contract terms captured in Icertis can flow directly into Ariba workflows, informing sourcing decisions, approvals, and payment controls. With Icertis’ AI continuously interpreting contract language and applying it across procurement and finance workflows in real time, the SAP Ariba-Icertis example provides an initial case study of a system of execution between CLM and S2P.

From an investor perspective, this example also signals the shift in where strategic value lies. Investors increasingly want to see platforms and ecosystems that unify contracts, suppliers, spend, and compliance within a single execution layer, amplified by AI.

Segment Implications: Who Benefits and How?

The implications of CLM–S2P convergence cut across company size but differ by segment.

Enterprises manage thousands of suppliers across jurisdictions, business units, and regulatory regimes. For them, aligning contract intent with procurement is about control and optimization at scale. A unified CLM-S2P system of execution that connects contracts, suppliers, and spend allows these organizations to enforce terms consistently, manage risk exposure, and maintain consistency.

Small and mid-market companies solve a different problem with this convergence, namely, managing legal and procurement complexity efficiently and cost-effectively. With leaner teams and fewer specialized roles, the priority is reducing operational burden. AI-enabled CLM and S2P workflows streamline intake, contracting, approvals, and purchasing, requiring less lift from costly personnel that can be deployed on higher-value initiatives. Additionally, these smaller organizations benefit from stronger governance and oversight.

This convergence also reshapes vendor management and third-party compliance solutions that are critical components of both CLM and S2P. When one platform unifies contract obligations, supplier data, and spend activity into a single execution layer, vendor and third-party governance and compliance embed into daily operations. Vendor and third-party oversight moves from periodic audits to continuous, automated enforcement. Onboarding, contracting, sourcing, purchasing, and payment now operate inside the same operational and compliance framework. As a result, organizations stop treating third-party risk management as a separate function. Instead, it’s a part of how business runs.

Strategic Implications: What Does the New Market Expect?

For software vendors, convergence raises the bar for what CLM and S2P platforms should deliver. CLM tools that silo within the framework of legal operations fail to operationalize the valuable data contained in contracts across the broader enterprise. Similarly, S2P platforms that simply optimize procurement transactions without real-time contract intelligence won’t be competitive in the evolving market. AI will be most useful as the vehicle that seamlessly “operationalizes” contract intelligence into purchasing execution. Therefore, the software innovators who embed AI into a unified CLM-S2P system of execution will perform better.

Investors and acquirers will reward the platforms that lead this evolving, new category. Market leaders will be those who control execution. AI strengthens this position by increasing switching costs: customers are less likely to replace platforms that constantly learn from their contract/supplier/spend data over time, making such tools even stickier than their CLM or S2P platform predecessors.

The Future of CLM and S2P: An Execution-centered Platform

AI changes the stakes for contract and procurement systems. By making contract terms, supplier data, and spend executable in real time, AI raises the cost of keeping these capabilities separate. Platforms that connect intent and execution will gain leverage as data compounds and rules are enforced at the point of sourcing, approval, and payment.

Similar trends are playing out in other sectors of legal and compliance technology as well. Take supply chain and compliance tech. Evolving regulatory frameworks continually create new complexities for supply chain teams that have recast supply chain planning software from operational infrastructure to compliance infrastructure. Compliance is no longer a parallel process running alongside supply chain or data analytics; they have all converged and shifted the investment landscape in a similar way to CLM-S2P.

As the CLM-S2P convergence continues, watch for architectural changes in emerging platforms, such as how data models unify and how workflows consolidate. With AI accelerating unification, platforms that turn contracts and procurement into a single, intelligent system of execution will be the ones to accrue long-term value.